Accounting & Auditing

Owners, creditors, investors, regulators, and other agencies require financial statements that accurately represent your financial position. JamisonMoneyFarmer PC’s accounting and auditing services are designed to meet the needs of these financial statement users as well as improve your ability to make decisions, improve profitability, and strengthen controls. Our approach starts with a strong understanding of your business and the risks your business faces. We then tailor our services in response to your needs and risks.

The accounting and auditing services we provide include:

- Audit, review, and compilation of financial statements

- Agreed-upon procedures

- Projected financial statements for business plans

- Internal control review

- Internal audit outsourcing

- Bookkeeping and payroll services

- Benchmarking and ratio analysis

- Cash flow projections and budgeting

- Financing assistance

- Debt covenant analysis

- Fraud investigation and litigation support

- Due diligence and financial analysis of mergers and acquisitions

- Assistance with technical accounting and financial reporting issues

Throughout the year, we can assist you with complex areas such as revenue recognition, leases, stock compensation, derivatives, business combinations, international transactions, and financial reporting and disclosure issues. Our team receives extensive training on the latest accounting and reporting guidance and attends industry focused professional development courses to keep abreast of industry issues.

We adhere to the highest standards of ethics, integrity, and confidentiality and instill these values in our staff. We assign individuals at the appropriate levels of experience, and we build long-term engagement teams to maintain staff continuity. Our shareholders are actively involved in client engagements and take a proactive role in consulting with clients on relevant issues and supervising the engagement team.

We undergo a “peer review” every three years by a team of specialists that review our system of internal controls established to ensure we are following the applicable standards of our profession.

Recent Posts

VIDEO: ASC 842 – The New Lease Standards

As we have mentioned for the last two years in this blog, it is time to implement the new lease standards. Our Accounting and Audit heads Lynn Osborn and Dan Johnson take a deep dive [...]

It’s time to implement the new lease standards

UPDATED March 22, 2022: Reminder that this must be implemented this financial reporting year i.e. it is effective for non-public companies (including not-for-profits) with fiscal years beginning after December 15, 2021 and interim periods [...]

JMF Office and Recent Legislative Updates

Dear JMF Clients and Friends: As we mentioned in our communication on March 14th, we are in unprecedented times. We wanted to share another update of what JMF is continuing to do to serve our [...]

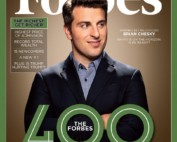

JMF Listed on Forbes America’s Top Recommended Tax And Accounting Firms

Photo Credit: Forbes Magazine Recently, Forbes Magazine partnered with the independent market research company Statista to create a list of the most recommended firms for tax and accounting services in the United States for [...]