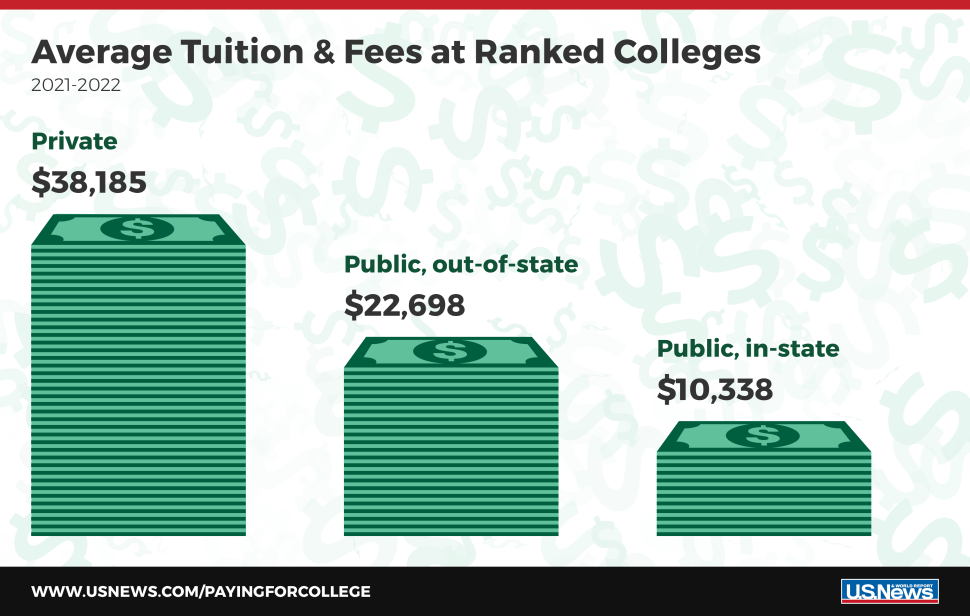

If your child will be attending college or graduate school next year, you probably do not have to be told about the sky‑high cost of higher education. You already know all about it from personal experience.

“At least my child has qualified for a scholarship to a prestigious university. That should take some of the sting out of the situation.”

For those students who are fortunate to receive such an award, this can definitely help defray the cost of attending school. However, some or all of the amount your child receives as a scholarship or a fellowship may be subject to federal income tax.

“I thought that scholarships and fellowships were completely tax‑free.”

Not exactly. This special tax exclusion is limited to amounts used by degree candidates for “qualified education expenses” at an educational institution that meets certain basic requirements (e.g., it has a regular faculty and student body).

“Exactly what sort of expenses are we talking about?”

The tax exclusion specifically covers (1) tuition and fees for enrollment and (2) fees, books, supplies and equipment that are required for study. However, the exclusion does not apply to amounts that are used for room and board.

“Can you show how the current rules work in an example?”

Suppose your daughter is awarded a $20,000 scholarship to attend the school of her choice. For simplicity, say that her tuition, books and supplies for the school year comes to $15,000, while room and board for the year is $10,000. Because your daughter can show that $15,000 is spent on qualified tuition and related expenses, only $5,000 of the scholarship is taxable.

“What if the scholarship is specifically earmarked for room and board?”

This designation controls for federal income tax purposes. For instance, if your daughter’s $20,000 scholarship specifically provides that $10,000 is to be used for room and board, then $10,000 is subject to tax. Keep this in mind when your child applies for scholarships.

“My son will be receiving a fellowship from his graduate school in return for providing teaching and research services. What are the tax ramifications?”

Any part of a grant that represents payment for past, future or present services is taxable. However, the special tax exclusion may apply to a qualified reduction in tuition received by an employee of the educational institution.

“Does the kiddie tax ever come into play?”

It might. With the kiddie tax, unearned income above an annual threshold received by a dependent child under age 19 or a full-time student under age 24 is taxed at the parents’ top tax rate. This includes certain taxable scholarships not treated as wages. The kiddie tax threshold for 2021 returns is $2,200 (going up to $2,300 in 2022).

Make sure you have a good understanding of the tax rules for scholarships and fellowships. You do not want to learn a tax lesson the hard way. Feel free to reach out directly to your JMF tax advisor if you have any questions.

Leave A Comment

You must be logged in to post a comment.