In April 2024, the US Department of Labor announced significant updates to overtime rules which is ushering in changes that impact workers. These changes will redefine how employers compensate their employees for extra hours worked. Understanding the intricacies of these regulations is crucial for both employers and employees alike to navigate the evolving landscape of labor practices effectively.

The new overtime rule addresses the threshold for exempting employees from overtime pay. Under the Fair Labor Standards Act (FLSA), certain employees are classified as exempt from overtime pay if they meet specific criteria, such as earning a salary above a predetermined threshold and performing certain job duties. The recent update raises this salary threshold, expanding the pool of employees eligible for overtime pay.

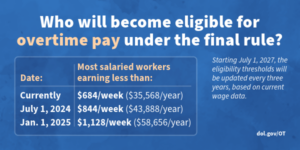

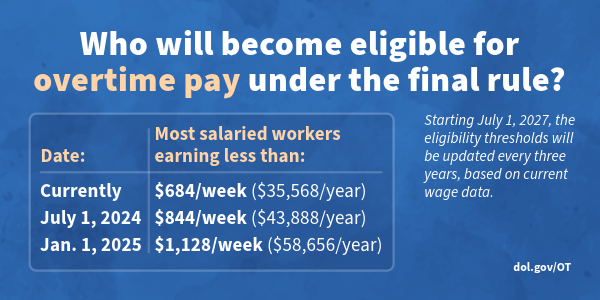

Visual from US Dept. of Labor

Key Changes and Implications:

- Increased Salary Threshold: See picture above. The next new threshold of $43,888 annually will be implemented on July 1, 2024 with another increase set for January 1, 2025 up to $58,656 annually.

- Enhanced Protections for Workers: By broadening the scope of employees entitled to overtime pay, the change reflects a commitment to fair compensation practices and acknowledges the contributions of all employees to the workforce.

- Compliance Challenges for Employers: While the new overtime rule brings welcome benefits for workers, it also presents compliance challenges for employers. Businesses must ensure they accurately classify employees and adjust their payroll practices accordingly to avoid potential legal ramifications and financial penalties.

- Impact on Operational Costs: For employers, the expansion of overtime eligibility may lead to increased operational costs, stemming from higher payroll expenses. Businesses need to assess the financial implications of the new rule and implement strategies to manage additional expenses effectively while maintaining operational efficiency.

- Opportunity for Workforce Optimization: Despite the potential challenges, the new overtime rule presents an opportunity for employers to optimize their workforce management strategies. By reevaluating scheduling practices, redistributing workloads, and investing in employee productivity tools, businesses can adapt to the changing regulatory landscape while maximizing the efficiency of their operations.

Conclusion:

The IRS’s new overtime rule marks a significant milestone in the realm of labor regulations, with far-reaching implications for both employers and employees. By understanding the key changes and proactively addressing compliance requirements, businesses can uphold fair labor practices while fostering a productive and engaged workforce.

Leave A Comment

You must be logged in to post a comment.