MARCH 20 UPDATE: This morning, Friday March 20, 2020, the US Treasury officially changed the filing due date for tax returns from April 15, 2020 until July 15, 2020. Tax returns and tax payments are now both officially due on or before July 15, 2020.

*******************

Things are moving very quickly, and there is a lot of confusion in the media and the general public about this “automatic extension”. It is our goal to keep you well informed, so we all can make the best decisions possible related to your individual and business tax returns.

Late Wednesday afternoon (yesterday), the IRS issued guidance related to a series of announcements and proposals that have been floated over the last week related to the COVID-19 outbreak.

The filing deadline for federal tax returns remains April 15, 2020. The IRS urges taxpayers who are owed a refund to file as quickly as possible. For those who can’t file by the April 15, 2020 deadline, the IRS reminds individual taxpayers that everyone is eligible to request a six-month extension to file their return.

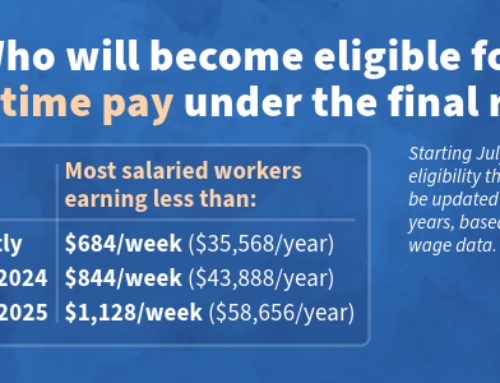

Penalties and interest will begin to accrue on any remaining unpaid balances as of July 16, 2020. If you file your tax return or request an extension of time to file by April 15, 2020, you will automatically avoid interest and penalties on the taxes paid by July 15.

If you would like to extend your return now, please email your JMF accountant and let them know.

Prior to the IRS issued guidance, the Alabama Department of Revenue indicated on their website that they planned to mirror IRS extensions as appropriate and enter corresponding taxpayer relief orders. The Department has not released an official statement at this time but we expect that it will be issued soon. We will keep you informed.

Who is affected?

Individuals: Income tax payment deadlines for individual returns, with a due date of April 15, 2020, are being automatically extended until July 15, 2020, for up to $1 million (single and married filing jointly) of their 2019 tax due. This payment relief applies to all individual returns, including self-employed individuals, and all entities other than C-Corporations, such as trusts or estates. IRS will automatically provide this relief to taxpayers. Taxpayers do not need to file any additional forms or call the IRS to qualify for this relief.

Corporations: For C Corporations, income tax payment deadlines are being automatically extended until July 15, 2020, for up to $10 million of their 2019 tax due.

In both cases above, the relief also includes estimated tax payments for tax year 2020 that are due on April 15, 2020.

If you love reading IRS tax guidance, read here: Relief for Taxpayers Affected by Ongoing Coronavirus Disease 2019 Pandemic; Notice 2020-17

Other COVID 19 Information That Might Interest You:

ADOR Extends Sales Tax Relief to Small Businesses Due to COVID19

Alabama Announces Support for Workers Impacted by COVID-19

JMF Office Update Amid COVID19 concerns

Chamber of Commerce of West Alabama COVID-19 Resource Page

Leave A Comment

You must be logged in to post a comment.